"Arkansas jobless rate up to 3.6% in November, jobs up 1.07% year-over-year"

Talk Business

December 20, 2019

"State jobless rate stays rooted at 3.5%"

Arkansas Democrat-Gazette

Northwest Arkansas Democrat-Gazette

November 20, 2019

"Arkansas' jobless rate remains steady at 3.5%; more than 1,600 new jobs added last month"

Talk Business

November 19, 2019

"State's jobless rate creeps up to 3.5%"

Arkansas Democrat-Gazette

Northwest Arkansas Democrat-Gazette

October 19, 2019

"Arkansas' jobless rate edges up to 3.5% as state labor pool sheds workers"

Talk Business

October 18, 2019

"Fort Smith accountant plays role in government reorganization"

Booneville Democrat

Southwest Times Records

October 13, 2019

"Accounting and Reorganization"

Jonesboro Sun

October 10, 2019

"More of Arkansas' schools graded A in year evaluation: Also, fewer F's handed out"

Arkansas Democrat-Gazette

Northwest Arkansas Democrat-Gazette

October 10, 2019

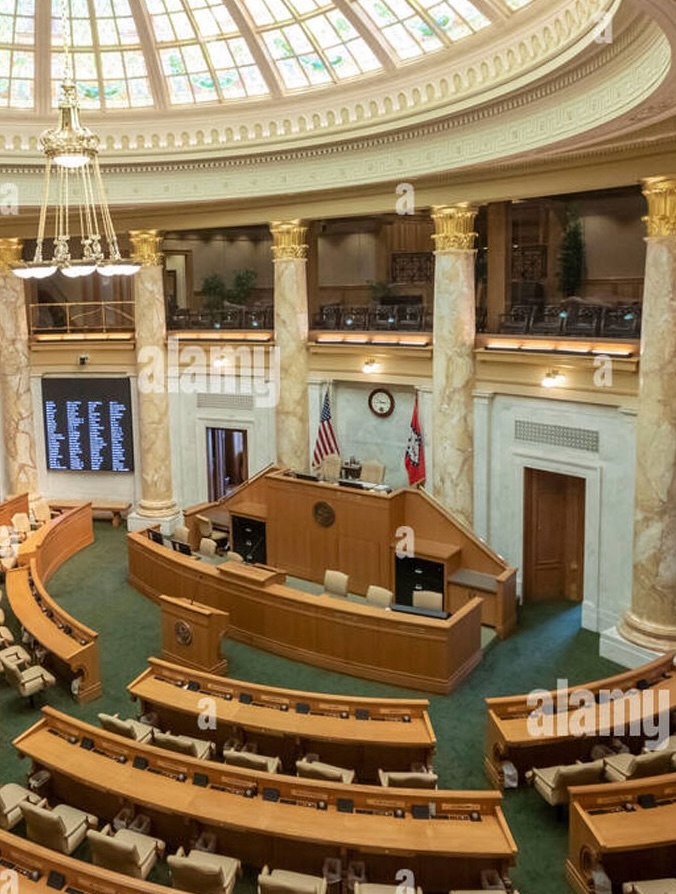

"How low can it go? (Arkansas' Unemployment Rate)"

Arkansas Democrat-Gazette

Northwest Arkansas Democrat-Gazette

September 30, 2019

"Recession Call Is Premature"

Talk Business

September 8, 2019

"Unemployment rate in state dips to 3.4%"

Arkansas Democrat-Gazette

Benton County Daily Record

Northwest Arkansas Times

August 17, 2019

"Jobless rate falls in state to 3.5%, lowest on record"

Arkansas Democrat-Gazette

Benton County Daily Record

Northwest Arkansas Times

July 20, 2019

"State's jobless rate steady at 3.6%"

Arkansas Democrat-Gazette

Benton County Daily Record

Northwest Arkansas Times

June 22, 2019

"Arkansas jobless rate holds at 3.6%, nonfarm payrolls at record levels"

Talk Business

June 21, 2019

"New era for performance measures"

Jonesboro Sun

May 23, 2019

"For efficiency: agency will define reorganization"

Arkansas Democrat-Gazette

Benton County Daily Record

Northwest Arkansas Times

May 6, 2019

"Reorganizing state government"

Arkansas Business

May 6, 2019

"The Texas school choice market"

Abilene Reporter-News

April 6, 2019

"Notes on a high-performing Delta county"

Talk Business

March 27, 2019

"State jobless rate up: industry gains"

Arkansas Democrat-Gazette

Benton County Daily Record

Northwest Arkansas Times

March 23, 2019

"Tax liens an overlooked problem in Arkansas"

Batesville Daily Guard

March 22, 2019

"State's jobless rate holds in January"

Arkansas Democrat-Gazette

Benton County Daily Record

Northwest Arkansas Times

March 12, 2019

"Speakers Circuit"

El Dorado News-Times

March 10, 2019

"Citizenship informs efficiency"

El Dorado News-Times

March 9, 2019

"Incentives to Pander"

Regulation

Spring 2019

"Give Families Freedom to Choose"

Arkansas Democrat-Gazette

Benton County Daily Record

Northwest Arkansas Times

February 5, 2019

"Arkansas manufacturing sector faces dearth of skilled workers with tight labor pool, low unemployment"

Talk Business

February 2, 2019

"Senate panel takes up governor’s transformation plan, asks for financial impact analysis"

Talk Business

January 22, 2019

"Arkansas joblessness rate stays put at 3.6%"

Arkansas Democrat-Gazette

Benton County Daily Record

Northwest Arkansas Times

El Dorado News-Times

January 19, 2019